Invoice financing can provide better cash-flow control where there may be different credit terms across your clients and customers.

#Invoice factoring financing professional

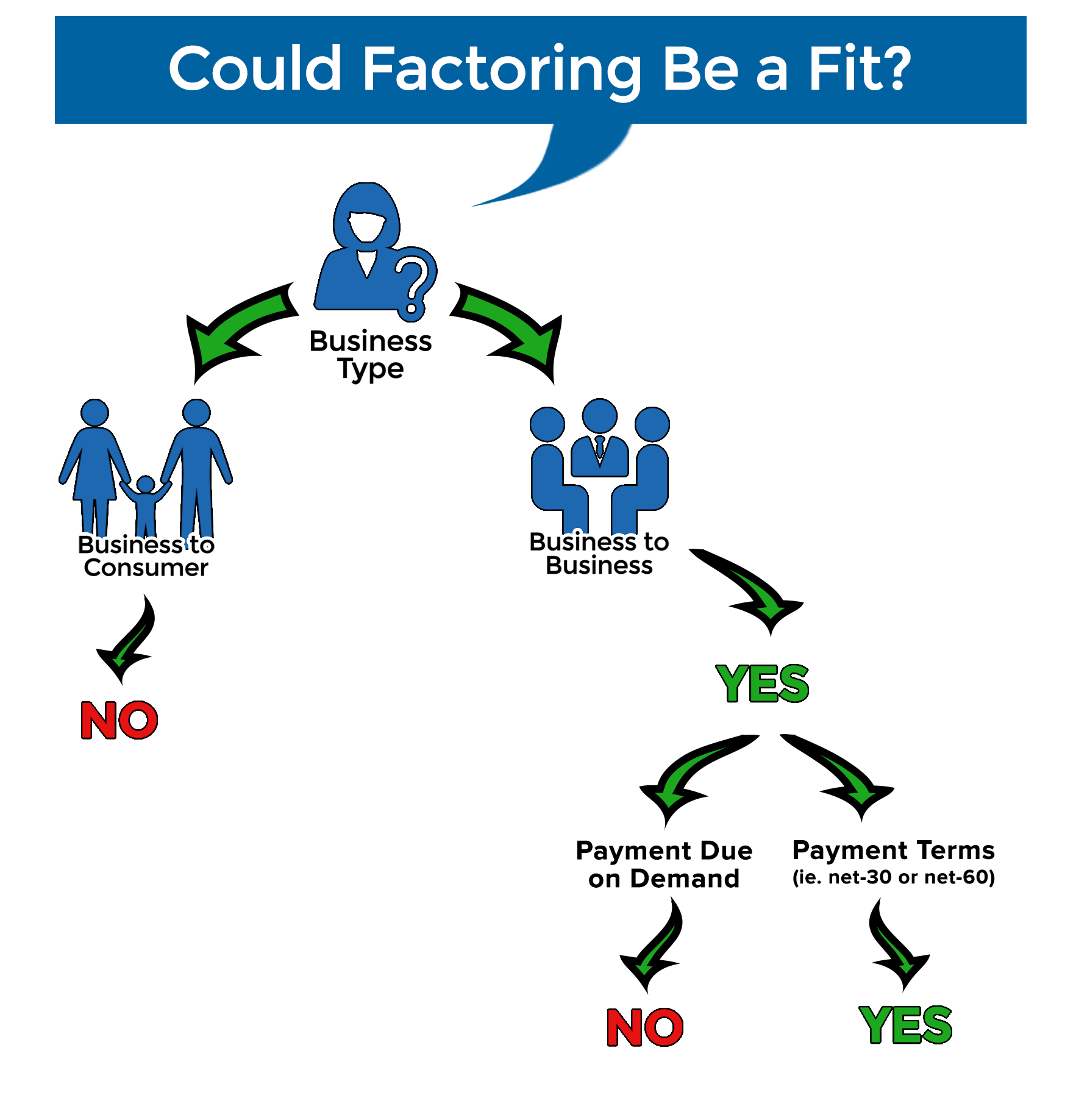

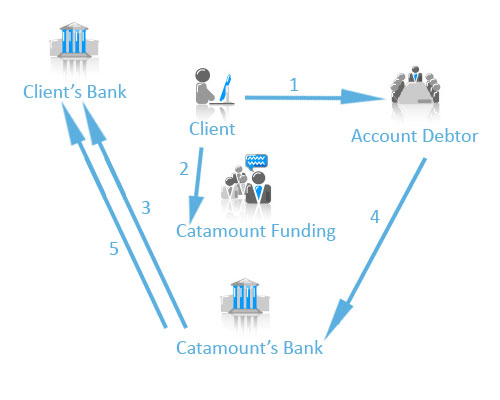

As experienced debt collectors, factoring companies’ professional and ‘gentle reminders’ can improve your customers’ and clients’ payment times on a long-term basis.Factoring is less expensive than turning to equity investors.Factoring amounts can easily expand and contract with your sales ledger.Take over the management of your credit control It can lower time spent on administration and chasing late payments since the factor assumes responsibility for collecting the debt and.A quick, safe source of cash flow by financing accounts receivable and releasing working capital tied up in unpaid invoices.Service Fee – This is the main admin fee charged by a factoring company and is typically 1-2%.Depending on the risk, complexity, and your customer’s credit ratings, discount rates vary between 1.5 and 5% of the invoice total. Discount Rate – The discount rate is calculated as a percentage of your company’s monthly use.Invoice factoring comes with two principal fees: discount and service fees. The remaining amount owed to your business for the invoices will then be repaid once the factoring company has collected the total value of the invoices from your customers. In this case, those might be around £800, so Dave would receive £3200 for this final payment.Īfter eligibility is established, the factoring company will purchase the unpaid invoices for a percentage of their value and then take over the debt collection process. The lender will raise the invoice, and then, once it’s paid, Dave’s company will receive the remaining invoice value minus the fees. The lender has also taken on the credit control as part of the arrangement, meaning Dave doesn’t have to worry about chasing invoices. Dave’s first invoice is for £20,000, which means he gets £16,000 upfront. He agrees to a factoring facility with a lender who offers an 80% advance. Once paid in full, the factor pays you the remainder of the invoice’s value minus the agreed fee.ĭave’s company has some cash flow issues, which invoice finance can help.The factor typically agrees to collect the remainder of the invoice when it’s due.After checking that they’re valid, the factoring company immediately pays you a percentage of the invoice’s value.You sell your invoices to a factor in exchange for a percentage of their value.Invoice factoring companies buy the invoices for a percentage of their total value and then take responsibility for collecting the invoice payments.Įssentially, to attain much needed working capital where invoices are taking long periods of time to get paid. It is a financial product that enables businesses to sell unpaid invoices (accounts receivable) to a third-party factoring company (a factor). Invoice factoring is sometimes referred to as ‘factoring’, or ‘debt factoring’. Invoice Factoring FAQ’s What is Invoice Factoring?.How Can a Business Apply for Invoice Factoring?.What is the Meaning of Reverse Factoring?.What’s the Difference Between Invoice Factoring and Discounting?.What’s the Difference Between Invoice Finance and Factoring?.How Does a Factoring Company buy Invoices?.Can Any Business Use Invoice Factoring?.We can also provide SBA guaranteed loans. Whether your business is small or large, existing or starting up, Garden Plain State Bank can develop a program to fit your business financing needs.

Garden Plain State Bank specializes in providing lines of credit, operating, machinery & equipment, inventory, construction and permanent real estate financing for your business needs. We also offer home equity loans for your borrowing needs. Contact us for a loan to purchase, refinance, and build your new home. Garden Plain State Bank offers a wide array of real estate financing products at competitive rates. Click here for an application (PDF format).įor additional information contact Garden Plain State Bank. So, whether you are purchasing a new or used vehicle, making improvements to your home, consolidating debt or planning that dream vacation, Garden Plain State Bank can help you.

#Invoice factoring financing full

Garden Plain State Bank offers a full range of loan services at competitive rates for all of your financial needs.

0 kommentar(er)

0 kommentar(er)